Secure the most important assets of your business and reduce costs.

What is a

Member-Owned

Group Captive?

A member-owned group captive is an insurance company owned and controlled by its members, providing coverage while reducing costs and returning profits to participants. Unlike traditional insurance—where carriers keep the profits—a member-owned group captive allows businesses to share risk, manage claims more effectively, and benefit from financial returns.

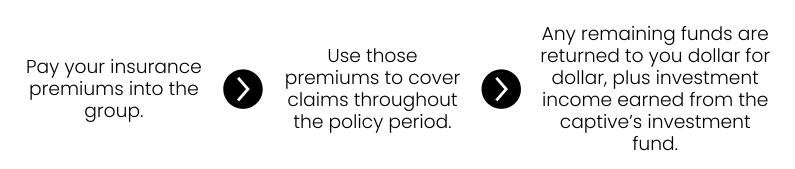

What is the Fundamental Idea of a Captive?

The concept of a captive is straightforward:

How is your premium allocated in a Group Captive?

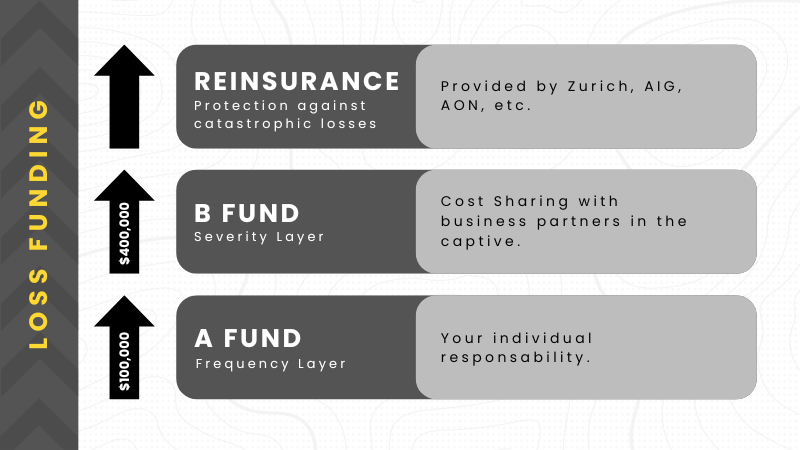

A Fund (≈48%-52%) .

B Fund (≈13%-15%) +

Operating Costs (≈36%-39%) +

Administrative Expenses (≈1%-3%) +

= Your Total Premium

What is the A fund and B Fund?

What is the Captive Investor’s Fund?

The Captive Investor’s Fund (CIF) has been operating for over 30 years. This is where your cash sits—securely held—until claims arise and throughout the time it takes for them to mature and close. The fund is conservatively managed, targeting 3–6% returns, and holds over $8.9 billion in assets diversified across bonds, equities, and alternatives such as hedge funds, real estate, and infrastructure.

At the end of the day, you’re not only getting your unused premium returned to you, but also earning investment income on those funds while they’re in the CIF.

Other benefits include:

Capital

A company with clean loss history may face increased premiums with commercial insurers due to a poor investment market or high claims volume, but a well-operated group captive can become profitable while insulating against risk.